Poka Yoke: A Solution to Improve Insurance Claims Reconciliation Process

Read the Magazine in PDF

Abstract :

Organization Profile:

Nethradhama Super Speciality Eye Hospital, founded by Dr. Sri Ganesh in 1994 as an eye clinic, has become a leading global provider of quality eye care over the past 26 years. Equipped with cutting-edge technology and highly skilled doctors, our main hospital is located in Jayanagar (OPD & Speciality Block), Bangalore, with additional branches in Rajajinagar & Indiranagar, Padmanabhanagar (Bangalore), and Mysore. We also operate LASIK centers in Mangalore and Davangere. Our commitment to excellence extends beyond patient care to the promotion and sponsorship of academic and research activities through the Nethradhama Education & Research Foundation, which offers DNB and fellowship programs, and the NSO (Nethradhama School of Optometry), affiliated with RGUHS. As part of our corporate social responsibility, we established the Shraddha Eye Care Trust (SECT), a charitable eye hospital located at Padmanabhanagar and Vasanth Nagar, Bangalore. At NSSEH, we believe that quality is an outcome, and we strive for continuous improvement through the use of qualitative measures, root cause analysis, and effective improvement techniques.

Introduction:

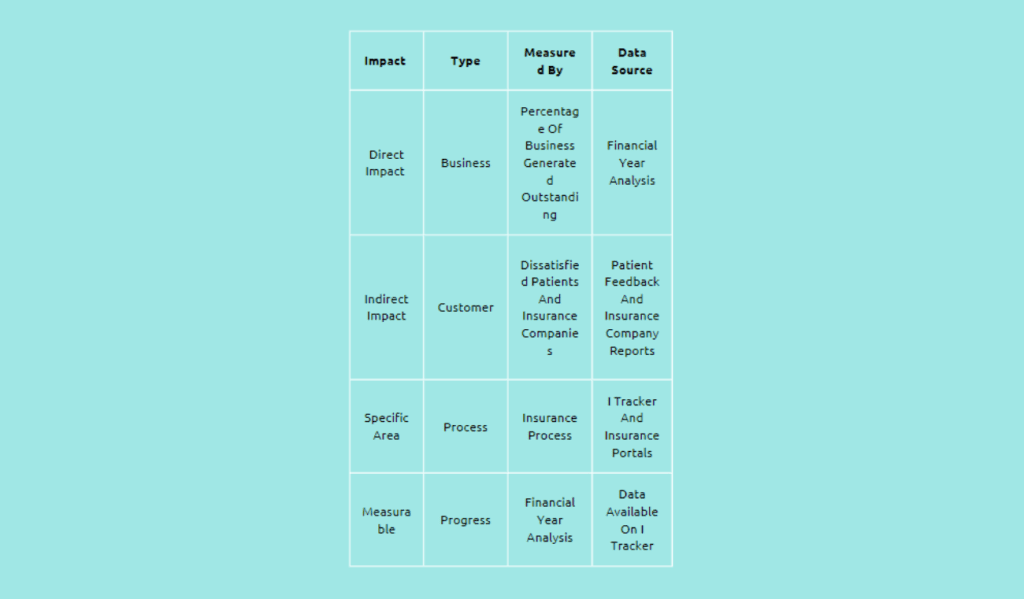

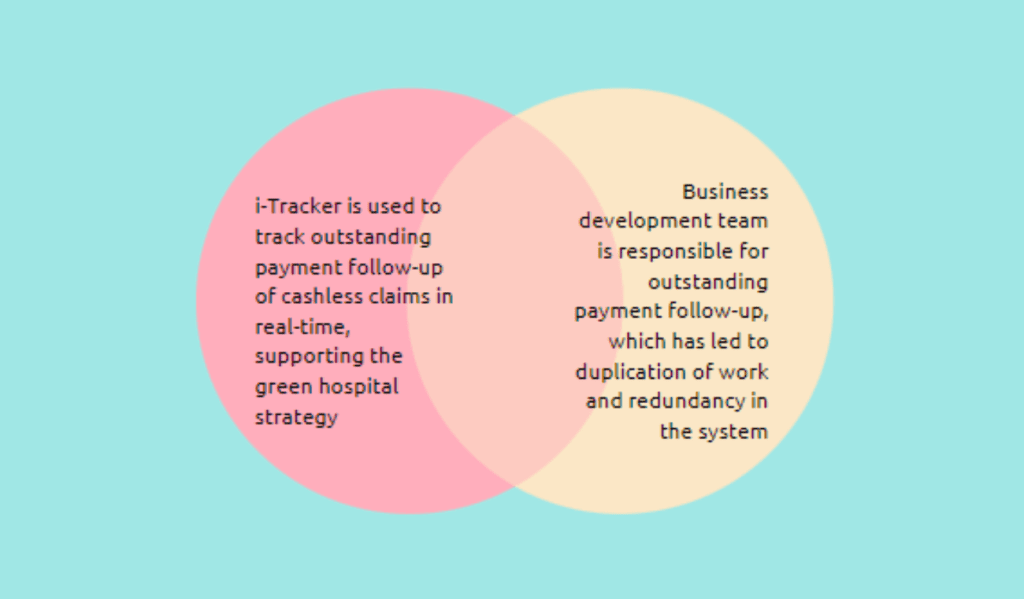

In January 2022, the insurance department underwent a change in process ownership, which led to an internal audit being conducted through i-Tracker (an HMS tracking tool) for the purpose of reconciling outstanding payments from insurance companies. The areas of concern were the turnaround time (TAT) for outstanding reconciliation and claim processing. The management was presented with a financial year analysis (FY 2019–2022) of outstanding and unreconciled payments, which resulted in the assignment of top priority based on the project charter. To ensure quality, the project team included the process owner, process and finance team, quality tool trainers, and senior leadership team. The quality tool implemented was Poka Yoke, which is a mistake-proofing technique. Moreover, the direct impact of the project is measured by the percentage of business generated that is outstanding for the financial year. The indirect impact is observed through dissatisfied patients and insurance companies. The specific area of focus for the project is the insurance process, which can be observed on I Tracker and insurance portals. The financial year analysis is used to measure progress, and all data necessary for follow-up and reconciliation is available on I Tracker.

Identifying the issue

Problems:

- Delay in follow-up with insurance companies after document submission leads to late payments and potential claim closure without cost.

- Processing claims through email leads to delayed responses and makes tracking claim progress difficult.

- Poor claim follow-up leads to delays in receiving settled claim payments.

- Inactive MOUs due to non-renewal with the revised client tariff.

- Mandatory supporting documents missing in a claim submission can lead to short payments.

- Tedious and time-consuming manual generation of 10-day reports by exporting to Excel

Root Causes:

- Processing claims through emails takes longer than using a digital tool like iTracker.

- Incomplete documentation and process errors cause delays and disallowances.

- Resistance to change and non-compliance with the iTracker update

- Duplication of work in the accounts department.

Benefits of Poka Yoke:

- Prevents defects and errors.

- Reduces errors and improves quality.

- Reduces costs and improves productivity.

- Enhances safety, ergonomics, and workplace morale.

Outcome:

POKA YOKE Tool Implementation: Prevention of the occurrence of error:

- Elimination of error-prone processes: Email process, telephone follow-up, irrelevant claim forms, manual document submission

- Replacement with more efficient strategies: Processing through online portals, minimal documentation, claim submission through an online portal after validation, checklist and rate list usage, use of insurance portal manual

- Facilitation of efficient processes: Dedicated contact person list from all insurance companies, use of iTracker to analyze claim payments, minimization of A3 size documents to A4 to eliminate waste, implementation of OPD cashless facility, opting for insurance packages when they are higher than TPA packages

- Depreciation: This is to reduce the effect of unavoidable errors

- Detection of errors: Disallowance and follow-up, processing fee to eliminate false claims, informing patients about hospital tariffs in case of claim denial

- Mitigation of errors: Insurance claim approval within 30 minutes, payment tracking and on-time reconciliation, documenting discount and disallowance separately in iTracker, eliminating discounts on MOUs.

Implementing the improvement measures involved several key actions to address the identified issues. These actions aimed to enhance efficiency, streamline processes, and improve error-proofing in the organization. To monitor progress and address any challenges, weekly meetings were conducted with Finance & Management, providing an opportunity to analyze the progress made and discuss any issues or concerns. Additionally, monthly Key Performance Indicator (KPI) meetings were held to assess the performance against established metrics and identify areas for improvement. To conduct a more comprehensive review, quarterly management review meetings (MRM) were conducted, allowing for a thorough evaluation of the progress and identifying any underlying issues that required further attention.

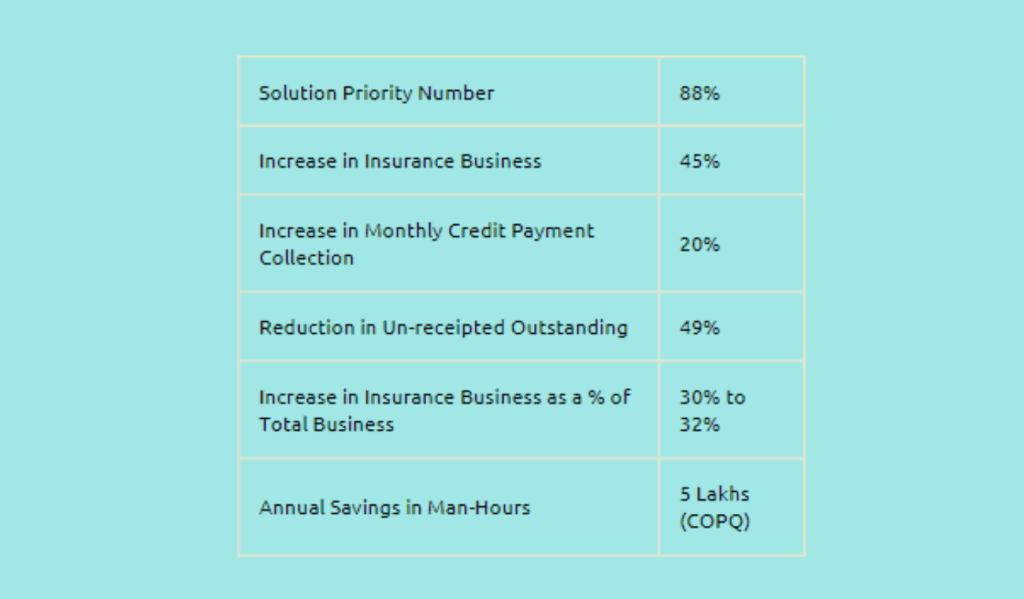

A new team was trained and audited to ensure the successful implementation of the Poka-Yoke tool, a method aimed at error-proofing processes. This training and audit process helped to ensure that the team members were equipped with the necessary knowledge and skills to implement and utilize the tool effectively. Claim submissions were analyzed and reviewed area-wise, allowing for a more targeted approach to identify and address any issues or discrepancies in the claims process. This analysis helped streamline the claim submission process and improve overall efficiency. Furthermore, training sessions on SPN scoring were provided to improve error-proofing principles. These sessions aimed to enhance the understanding and application of error-proofing techniques, minimize the occurrence of errors, and improve the quality of processes. In the next improvement phase, the focus will be on unsettled claims, which constitute a significant portion of outstanding shares. This targeted approach addresses the backlog of unpaid claims, improves overall financial performance, and reduces outstanding liabilities. Furthermore, to replicate the successful improvement measures, several actions were taken. The Poka-Yoke tool, initially implemented to streamline the clinical process for emergency patients attended by residents after working hours, can now be replicated in similar scenarios to enhance efficiency and reduce errors. The administration department took steps to convert committee registers to soft copies, promoting digitalization and streamlining the administrative processes. This can be a model for other departments or committees to adopt, reducing paperwork and improving efficiency. A colour-coding system was introduced for IOLs (intraocular lenses) to eliminate errors in the operating theatre, minimising the chances of mistakes during surgical procedures. This colour-coding system can be replicated in other areas where visual cues can help prevent errors, promoting patient safety. A colour-coded duty roster was created for residents, ensuring clear communication and the organization of responsibilities. This method can be replicated in other departments or teams to improve coordination and efficiency in work schedules. The organization can extend the benefits realized in specific areas to other relevant contexts by cloning these improvement measures, promoting standardization, efficiency, and error reduction.

Conclusion :

Nethradhama Super Specialty Eye Hospital successfully improved its insurance claim processing system by implementing the Poka Yoke tool. The hospital prevented, reduced, and minimised errors, improving quality, increasing productivity, and lowering costs. The hospital was able to eliminate error-prone processes, replace inefficient processes with efficient ones, and minimize unavoidable errors. The hospital could also lock in the improvements by holding weekly meetings with finance and management, monthly KPI, and quarterly MRM meetings. The hospital plans to focus on unsettled claims in the project’s next phase.