Sustainable Financing

Read the Magazine in PDF

What is the role of financial institutions in Sustainability?

The world bank estimates India’s GDP will take a 2.8 per cent annual hit by 2050 due to climate change. Unusual and unprecedented spells of hot weather are expected to occur far more frequently and cover much larger areas. Falling water tables can be expected to reduce further due to increasing demand for water from a growing population, more affluent lifestyles, and the services sector and industry.

What is Sustainable Financing

When investing, you consider the environment, social and governance parameters –portfolio companies, projects, buy equity. Long term investments-Debt and Equity 10-15 years. Grants-5 to 10 years by multilateral/bilateral funding organisations Climate bonds/ Socially responsible investments/ Ethical investments/ impact bonds.

Since the early 80s, ESG considerations have been gaining importance in financing World Bank’s first green bond in 2008. The US has the highest number of green/ climate bonds. However, in the last decade, more rigour has come to it. India has issued green bonds worth about $8 billion since January 1, 2018, constituting about 0.7 per cent of all the bonds issued in the Indian financial market, as per the Reserve Bank of India’s (RBI) bulletin.

An Indian conglomerate has acquired a green loan by integrating ESG goals as part of the agreement by setting targets on water consumption and GHG emissions. Another Indian conglomerate has signed a sustainability-linked loan agreement with a multinational lender to raise debt capital. An Indian bank has developed a sustainable finance and green bond framework, setting up the process and declaring its intent.

Can you explain the developments from International Financial institutions & how the corporates have reacted to them?

Development Financial institutions play a significant role in the social and economic development of countries with emerging economies. This includes advising, funding, and assisting with development projects to: reduce global poverty and improve living conditions and standards. Support sustainable economic, social and institutional development. India had set up the Industrial Finance Corporation of India, the Industrial Development Bank of India and the Industrial Credit and Investment Corporation of India.

London Stock Exchange reports majority (88%) of asset owners who responded to the FTSE Russell 2022 Sustainable Investment Survey stated that they are implementing or evaluating sustainable investment considerations into their investment strategies – nearly double the percentage from five years ago. They continue to report the 2023 LSEG Investor Relations Study, h polled 129 investor relations specialists at a range of publicly listed and private companies, revealing that investor interest in ESG policies and performance was rising. Three-quarters believe that investors are more interested in sustainability than two years ago.

Similarly, respondents expect that interest to keep growing. Seventy per cent said that existing investors would likely become more interested in sustainability over the next two years.

The contribution to the Healthcare footprint is distributed as Scope 1 – 17.5%, Scope 2 – 12.6%, Scope 3-70%. The large emissions coming from Scope 3 is attributed to emissions from production and transport, services, disposal of waste, food and agricultural products, medical devices, hospital equipment and instruments as depicted by Healthcare without Harm in below pic.

The healthcare sector must take responsibility for the reduction of footprint and be part of the solution to the growing climate emergency in addition to treating injured and ill people. This can be achieved by a detailed study of emission sources within the sector at the organisation’s level, reviewing the facilities, systems and supply chain, and making climate goals to achieve net zero emissions by 2050 or before. The organisation may take a scientific approach to achieving the goals, fix the science-based targets, apply for carbon disclosure programs, and gain credibility for their actions. To combat greenhouse gas emissions and be better prepared for Climate resilience, Sustainable procurement is a handy tool that enables the incorporation of environment, governance, and social elements into procurement processes, intending to minimize environmental impact and achieve positive social outcomes.

It surpasses financial considerations by benefiting the organization, the environment, and society. Consumers seek transparency in today’s sustainability-oriented era, while companies aspire to be leaders in Sustainability stewardship. There is a dire need for the Healthcare Industry to understand what Sustainability is and how it contributes to understanding this across the lifecycle. Adopting the (TBT) triple bottom principle of the United Nations needs a conceptualisation effort to relate themselves and how they can extend their influence over the value chain. Sustainable procurement enables businesses to showcase their dedication to sustainable practices—the practices based on the triple bottom principle depicted below.

Corporates are talking about sustainability now more than ever before

Naturally, this interest triggers action from investee companies, increasingly seeking to provide investors with the information they need to inform sustainable investment decisions. Over half of the companies had developed new ESG strategies or policies in the previous 12 months. Around three in five companies also produced materials with ESG information or communicated ESG credentials and achievements.

ESG considerations are becoming embedded into business strategy by companies with capital requirements. In February, the cash management platform Treasury Spring released the results of its 2022.

Sustainable Finance Survey

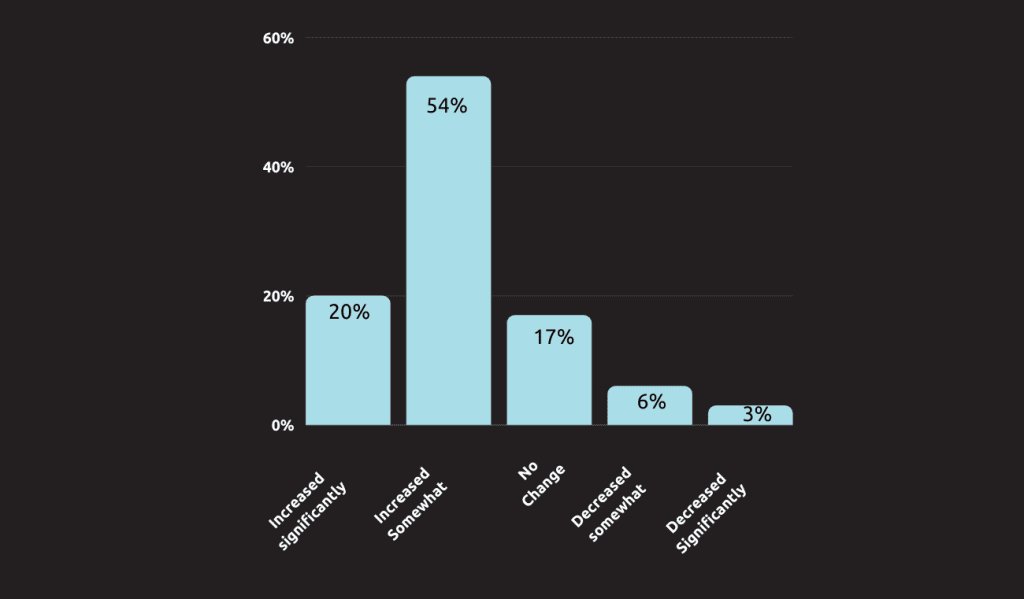

In partnership with the London Stock Exchange and investment portal ICD, the survey sought to understand how treasury teams think about sustainable finance. It found that 87% of respondents consider ESG investing somewhat or very important to their organisation.

What’s the role of S in BRSR?

BRSR is made mandatory for 1000 listed companies, and the verification of BSRS is also made compulsory for 250 companies. Regulators in India have in the BRSR placed emphasis on Environmental & Social aspects and parameters for not only the applicable company’s internal operations but going beyond and addressing the value chain. Employee well-being, Health & Safety, Human rights, supply chain management, training and awareness has been given importance. Principle 3 of BRSR has in-depth employee coverage. Going beyond regulators also emphasises community engagement in the company’s area of operations. Principle 5 speaks of Human rights assessment and parameters. Integration of Social parameters in business agreements has also been sought in questions asked by regulators. Principle 6 talks of environmental performance reporting on Energy & GHG, water consumption and withdrawal, solid waste management, 3 R practices, Sustainable sourcing, extended producer responsibility, Life cycle assessment.

How can the Healthcare sector relate themselves with the expectations of lending organisations?

Climate change is impacting human health and testing the resilience of health systems, especially those in Low & Middle-Income Countries (LMIC).

This phenomenon is expected to lead to the need for additional spending on healthcare in the decades ahead. Therefore, the need for aligning climate adaptation & mitigation financing with health will need to become part of a lender’s priority list. Already, we are seeing demands being made by LLIC countries for financing through the Loss and Damage Fund that was created at the COP27 climate summit. We do foresee funding for health through the lens of climate vulnerability taking a more significant role.

Similarly, for hospitals seeking external funding, preferential lending for projects aligned with climate goals or net-zero/carbon neutrality targets will mature over the next few years. These could include funding for upgradation & green retrofitting, green-certified buildings, capital expenditures for green technologies, funding for phasing our fossil fuels and decarbonisation in hospitals etc.

Further, funding is acutely felt for attaining the SDG 3 – Good Health & Wellbeing targets. Attaining these lofty aspirations will need funding from diverse sources – donor financing, revenue mobilization, taxation, private spending, priority lending etc. Also, as the pandemic has demonstrated, the need for building resiliency in health systems to continue to provide services in the face of existential crisis will need to be further strengthened.